I Help My Clients Repair Their Credit and Get Out Of Debt Using My "8 Point Validation System."

It doesn't matter how bad your credit is. I'll teach you how to start challenging negative information on your credit reports and how to stop debt collectors from collecting old outstanding debts that are not legally validated.

After 19 years in the business I've decided to share all of my credit repair and debt elimination secrets! If you are tired of living with bad credit click the link below to get access to my credit repair secrets immediately.

Steven A Williams, President & Founder

BREAKDOWN OF HOW WE CAN HELP YOU WITH SPECIFIC NEGATIVE ITEMS ON YOUR CREDIT REPORTS

Medical Collections

Regardless if you owe a medical bill or not. The medical provider must not disclose any of your personal medical information to a 3rd party. They can be sued if they do disclose your personal information. This also put you in a great position to have the item deleted off of your credit reports.

Identity Theft

You might find it difficult to make companies do the right thing when it comes to getting negative credit off of your reports due to ID Theft of your personal information. This process must be done using documents that the agencies and federal agencies provide. We handle all of that for you and usually all negative information will be removed in 30 to 45 days.

Collections

Collections can be from an old credit card, payday loan, medical bills, personal loans, cell phone, cable bills, etc. When dealing with collections there is a specific process that must be validated to make sure it is a valid debt and can be legally collected. We handle that process.

Late Payments

These can drop your credit score down as much as 20 to 30 points in some cases. We use several strategies to get creditors to reverse late payments. This must be done the right way or you can end up having the account closed or all the good history deleted making your score drop down more.

Foreclosures

Most mortgage companies don’t come after you for a foreclosure after the process is done. But having the mark on your credit reports can hurt your ability to move forward and get approved for new credit. We have several validation processes in place to get a foreclosure removed including if your mortgage was sold over and over and your original mortgage provider was either fined by the federal government or closed down.

Duplicated Accounts

This can happen when an original creditor sells an account to a debt collector. Technically they can report the previous history, but if they say they sold the account they technically have been paid for the account.

Charge Offs and Write Offs

These are technical terms for a debt being reported as a loss on their accounting books. This doesn’t mean that can’t collect on the debt. They can’t report the debt as an asset on their books.

Soft Inquiries

These are inquiries the credit reporting agencies allow to be placed on your reports to allow you to see who purchased your data to market to you. It has no effect on your scores and doesn’t hurt you.

Hard Inquiries

These are inquiries that you’ve approved to be made by companies looking to give you credit. These can drop your scores and having too many of them can hurt you from getting approved for a loan. There are specific strategies that can be used to get hard inquires off of your reports and we use these to get them removed.

Auto Repossession

If your vehicle has been repossessed you have a lot of rights that you need to be aware of. Regardless if you give the car back willingly or if they take it without you knowing. A process will be started to sell the car at auction and they will come after you for the deficiency. That is the balance owed after the car is sold at auction. We make sure that they followed the law at every step including the original contract, how they took the vehicle and getting the final auction receipt.

Incorrect Personal Data

This can hurt your credit scores and hurt your ability to obtain credit due to mistakes on your reports personal data section. These can include misspelling of your name, Sr, Jr, II that is added to one report and not matching another report. Addresses and other personal information. We will make sure that this is updated and matches all 3 reports.

Un-identified Collections

These are collections that are usually purchased by a debt collector and you didn’t respond to the 30 day validation letter they sent in the mail. Don’t worry if they don’t disclose the debt properly on your credit reports it must be removed. There is a specific process to get this done and we take care of that for you.

Garnishments

We can help you get garnishments stopped in some cases. Depending on the laws in your state you might not qualify to be garnished or qualify to have it reduced. We will assist you in finding out and help you get it resolved.

Settlements

In some cases you may have to pay a collection when 100% proven by the collector. We will assist you in negotiating a discounted settlement to help you get pass it and move forward in your life.

Bankruptcies

You cannot legally file bankruptcy and dispute that you didn’t file bankruptcy on your credit reports. The bankruptcy must show correctly and if there are in inaccuracies in the placement it must be removed immediately. We have several strategies to get this done for you.

Tax Liens

We can assist you with doing an offer in compromise for an additional fee. We handle state and federal tax liens.

FULL DISCLOSURE PLEASE READ:

We cannot guarantee a specific result. Credit repair involves 3rd party credit reporting agencies, creditors and furnishers (such as: collection agencies) because of that we cannot guarantee a specific time-frame to complete your credit repair and we cannot guarantee a specific result.

If you feel that a misrepresentation was made by an employee of our company please immediately call our office at 414-374-3390. We will always be available during business hours to assist with your question and concerns. You also have the option to cancel at anytime.

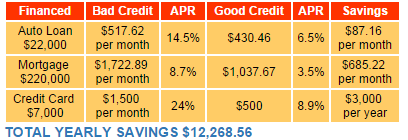

Your Credit and Credit Score MATTERS!

Your credit and credit score plays a huge part in lowering your interest rates when it comes to buying a car, home, loans, credit cards, renting an apartment. You should also be aware that Auto, Life, Home and Health Insurance companies will check your credit to determine what rates you’ll pay. Employers are also looking at your credit report to determine if they will hire or promote you to a position.