Building credit without a credit card can be challenging, but it’s not impossible. Here are some ways to build credit without a credit card:

- Get a credit builder loan: Credit builder loans are small loans designed to help people build credit. The money you borrow is held in a savings account, and you make monthly payments to pay off the loan. Once the loan is paid off, you get the money in the savings account.

- Become an authorized user on someone else’s credit card: If you have a family member or friend who is willing to add you as an authorized user on their credit card, this can help you build credit. Make sure the primary cardholder uses the credit card responsibly and pays on time, as this will reflect positively on your credit.

- Get a secured credit card: Secured credit cards require a cash deposit as collateral, which is usually equal to the credit limit. By using the card responsibly and paying the balance in full each month, you can build credit.

- Pay your bills on time: Even if you don’t have a credit card, paying your bills on time can help build credit. This includes rent, utilities, and other bills that report to the credit bureaus.

- Consider a credit builder account: Some financial institutions offer credit builder accounts, which work like a savings account. You make monthly payments, and the bank reports your payment history to the credit bureaus. Once the account is paid off, you get the money in the account.

- Take out a small personal loan: If you need to borrow money, consider taking out a small personal loan. Make sure you can afford the payments, and pay on time to build credit.

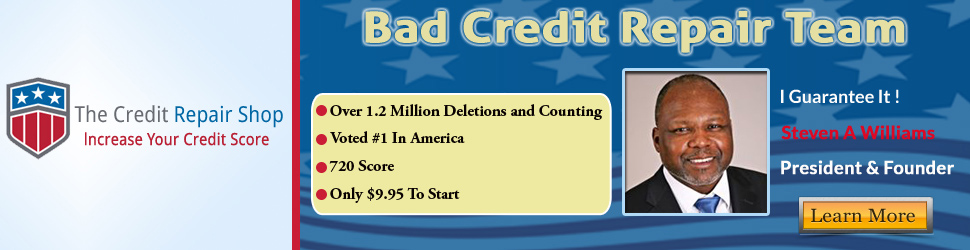

Want to sign up for our credit repair membership services – CLICK HERE